A Quick Introduction...

Hello, My name is Jai Thompson, USN Veteran and I am the Chairman of King Jai Real Estate Group, KJ Commercial Group, Jai Buys, Houses, LLC. I have been active in creative real estate since 2015 and have been involved in over 200 real estate transactions. Those transactions have ranged from $15,000.00 homes in Atlanta, GA to multi million dollar estates in Los Angeles California.

King Jai Real Estate Group Investor Portfolio

I think about my portfolio in two parts – retirement accounts and taxable accounts. For me, these require two different strategies.

The retirement money I don’t plan on touching for another 25-30 years, so I’m much more tolerant of risk.

The taxable account, on the other hand, is money I might need sooner. It’s not an emergency fund, which I have in just cash, but I’d like to avoid losing half the value in a market crash or severe drawdown.

What if I’m out of work or need a down payment on a car or a house? I actually did this recently in the case of the down payment. I didn’t actually know I was going to buy a house, so I should have planned better for that scenario, but that’s another story.

Taxable Account Portfolio

In any case, here’s a look at the allocation of my taxable account

The other category is for a fund I’ve come to really appreciate called the AGFiQ U.S. Market Neutral Anti-Beta Fund (BTAL). What is does essentially is short the riskiest stocks in the market and goes long the least risky.

The result is it does really well when the market is going down, and just ok when the market is hot. Combine that with a basic US equity ETF and you have returns that are better than bonds and far less volatile than stocks. In other words, you can make money in up or down markets.

The downside, of course, is that when stocks are rising you’re only participating in some of the upside. But you’re probably not going to get killed if there’s a big sell-off.

As you can see I also have about 40% in bonds. While bonds have very low yields right now, I still believe they’ll do well when investors are looking to reduce risk.

If I need more money than what I have in the emergency fund, I want to be able to draw from something that isn’t going to be down 20% at any given moment.

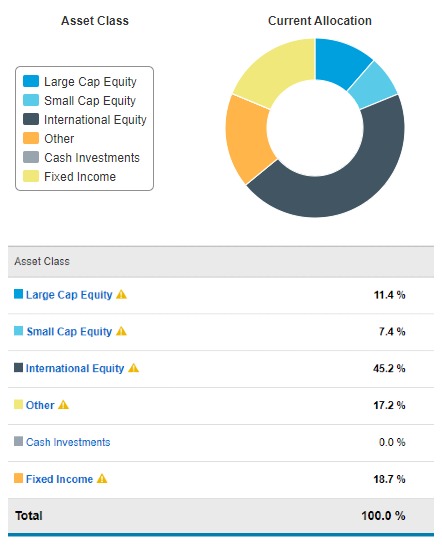

Retirement Account Portfolio

Now here’s a look at the retirement allocation:

As you can see there’s far more in stocks – and particularly foreign stocks, which I think are a better value at the moment.

Riding the ups and downs of the stock market is much easier, for me, when I don’t plan on touching the money for a few decades.

In fact, it’s better if they go down, because it gives me the chance to buy more at lower prices. If you’re in a 401k, this works beautifully, because you don’t even notice the money coming out of your check and going into stocks

Updated: December 3, 2022